tax benefit rule calculation

The business mileage rate for 2022 is 585 cents per mile. Accordingly we can calculate the true economic benefit of tax loss harvesting over time by comparing the amount of wealth created by harvesting the loss comparing it to.

Tax Season How To Write Off Ivf On Your Taxes

The tax benefit shown in the summary section is defined by the following equation.

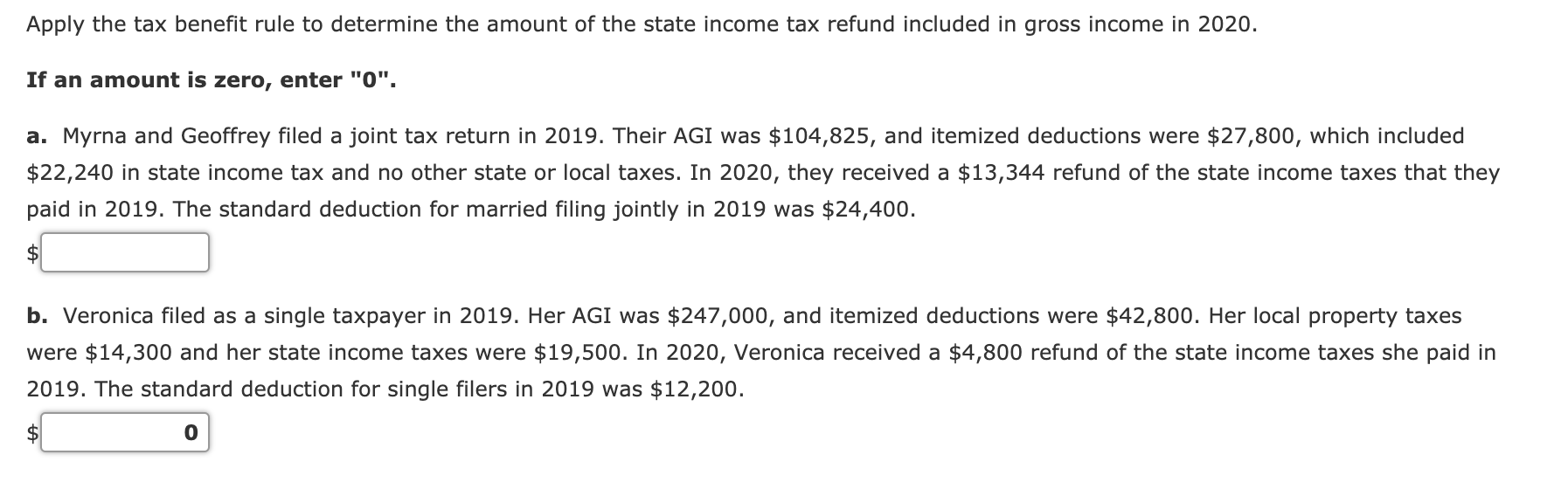

. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from. If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction.

The TAB is calculated by using a two-step procedure. Line Calculate the tax amount on a. Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked.

So if you owed 1500 in taxes and then took a 1000 credit your tax bill would be 500 1500 - 1000. If inclusion of the refund does not change the total tax the refund should not be included in income. However if total tax increases by any amount a tax benefit was received.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. The following options are available. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a.

Definition of Tax Benefit Rule If you recover a cost that you had deducted in a previous year you must include it in your income in the year that it is recovered. Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new.

The tax benefit rule is a feature of the United States tax system. Tax benefits include tax credits tax deductions and tax deferrals. When the couple paid the excess refund 400 to.

The tax credit reduces your tax bill by that same 1000. This is done by calculating the present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortization charges in the tax. If the full 5000 refund were disallowed their limited tax deduction under the TCJA would drop to 9000 from 10000 resulting in an increase in taxable income and an.

You are given a 15-year bond with a face value of 1500 and it matures in six years. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit. You may use this rate to reimburse an employee for business use of a personal vehicle and under certain.

In the Calculation method field select whether taxes on invoices are calculated for each line or all lines. COMPLETE YOUR TAX FORMS. What form of tax will be applied once the bond is sold.

The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be. Tax treatment of state and local tax refunds clarified. Example with Calculation.

Tax Benefit Rule Previous Deduction Recovery Los Angeles Cpa

What Is The Tax Benefit Rule The Benefit Rule Explained

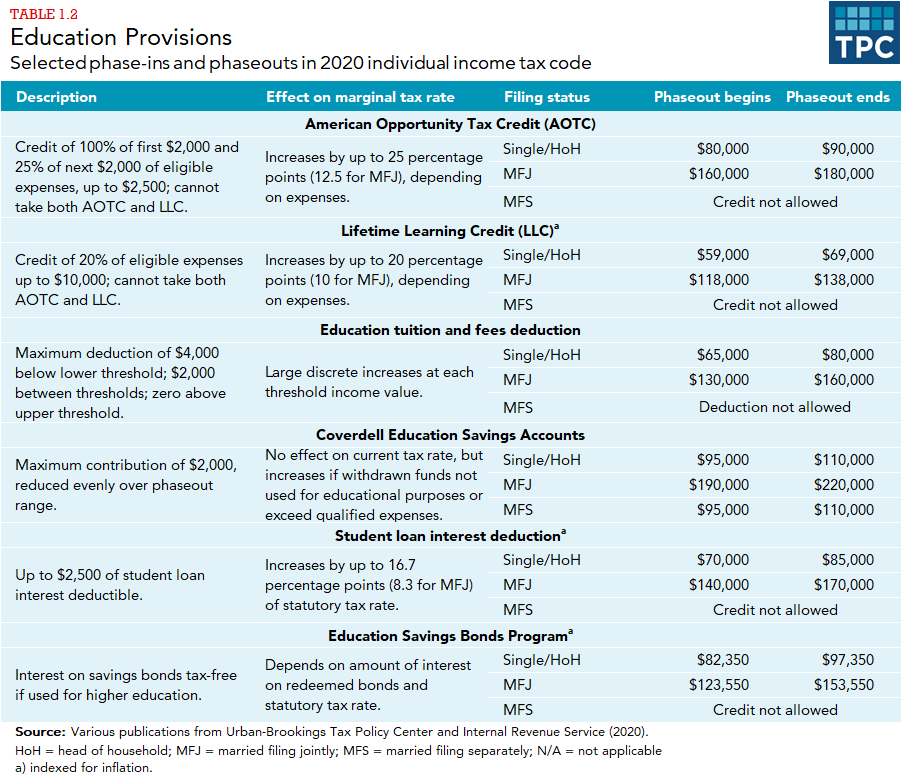

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

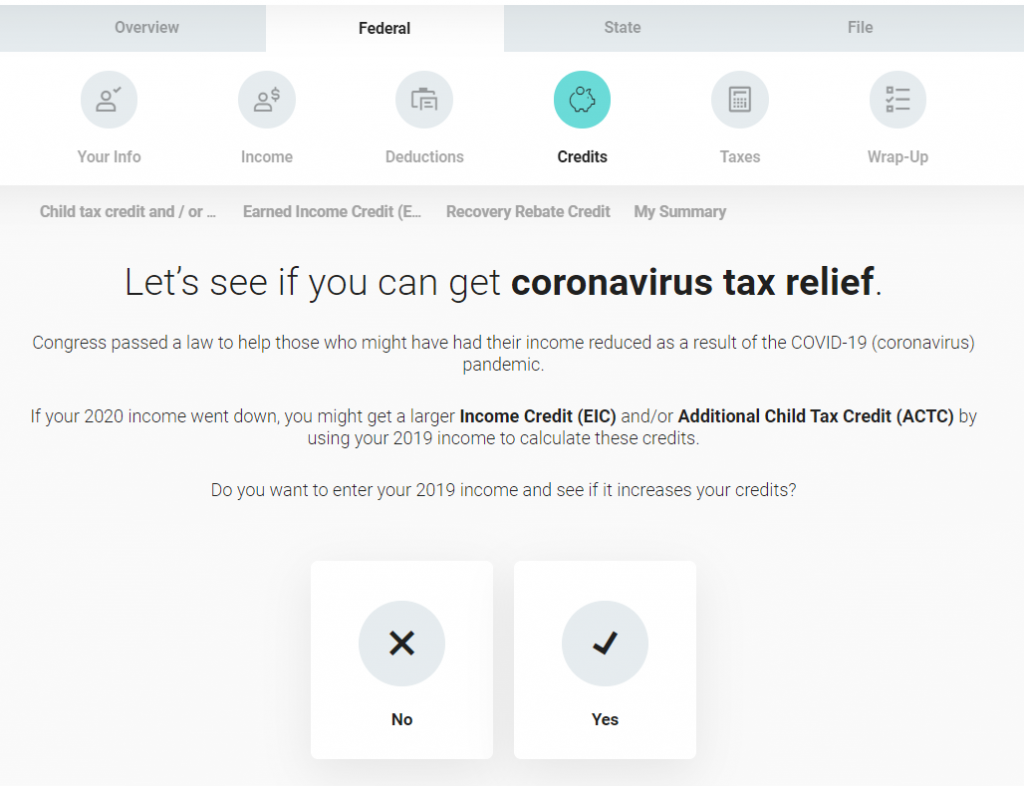

How To Calculate Earned Income For The Lookback Rule Get It Back

Tax Planning For Retirement Ameriprise Financial

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

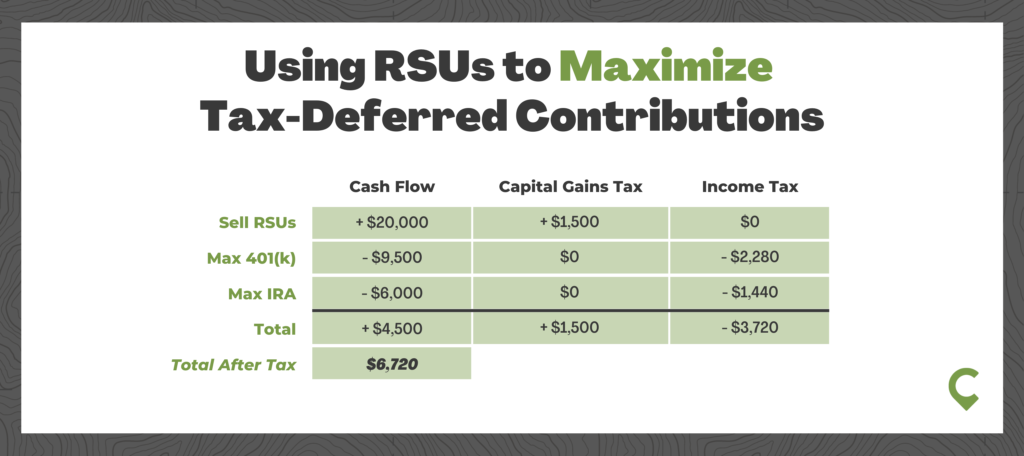

Rsu Taxes Explained 4 Tax Strategies For 2022

Tax Benefit Rule Of 111 Should Shield State Tax Refunds For Taxpayers Over The Salt Limit Current Federal Tax Developments

How The Tcja Tax Law Affects Your Personal Finances

Tax Benefit Rule Doctrine Explained With Exam Cpa Exam Regulation Income Tax Course Schedule A Youtube

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Home Office Tax Deductions Faqs Bench Accounting

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

What Is The Tax Benefit Rule Thestreet

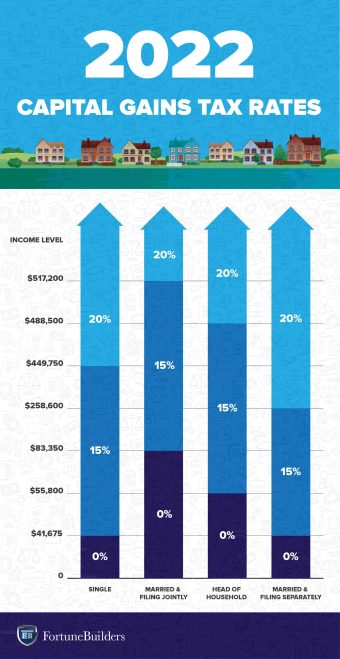

Tax Changes For 2022 Kiplinger

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com